Alert 02.04.25

Federal Funding in Flux: Policy Shifts and Uncertain Terrain

Executive orders, funding freezes, and what’s next for federal disbursements

Service

Contacts

Pillsbury helps clients identify and capitalize on federal funding opportunities related to the Infrastructure Investment and Jobs Act (IIJA), CHIPS Act and Inflation Reduction Act (IRA).

Our team leverages strong relationships in Washington, DC, along with the expertise of our Energy, Regulatory, Corporate, International Trade and Government Contracts authorities, to track and advise on key developments and related opportunities for business. Lawyers across the firm are working with clients to assess available federal incentive and funding pathways, prioritize projects and needs, and develop strategic plans for pursuing these opportunities, in addition to providing guidance on important compliance considerations, such as domestic content requirements and federal program compliance.

The IIJA, a mammoth $1.2 trillion funding package, constitutes the largest infusion of federal investment into infrastructure in over a decade, impacting almost every aspect of the American economy.

View More

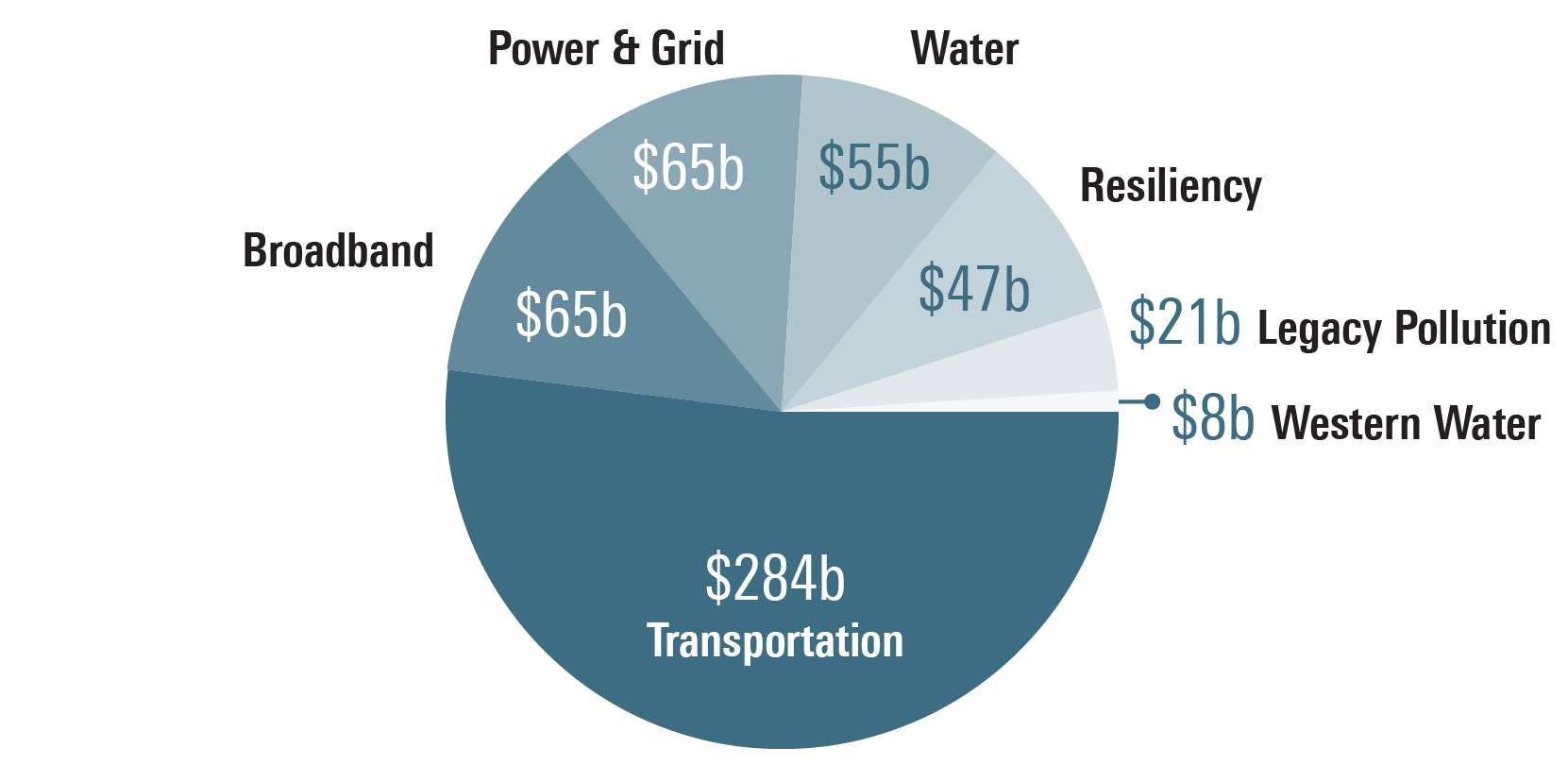

This transformative legislation provides substantial funding for the improvement of aging roads, bridges, airports and rail lines; modernization of electrical grids; advancement of clean energy production; expansion of high-speed internet access; upgrading of water infrastructure; fortification of government cybersecurity efforts; enhancement of public transit; and better protection of the environment.

Topline above-baseline spending in Infrastructure Investment and Jobs Act (USD)

Topline above-baseline spending in Infrastructure Investment and Jobs Act (USD)

Pillsbury is closely monitoring developments regarding the Infrastructure Investment and Jobs Act, offering timely updates on the politics and policies surrounding it and the emerging opportunities it presents across sectors.

New Federal Spending:

The CHIPS Act directs $280 billion to build, expand or modernize domestic facilities and equipment for semiconductor fabrication, assembly, testing, advanced packaging or research and development (R&D), with a majority of funds dedicated to scientific R&D and commercialization.

View More

CHIPS Act funds are distributed through programs at the National Science Foundation, the Department of Energy and the Department of Commerce. Pillsbury assists clients in preparing for all stages of the CHIPS application—including a statement of interest, pre-application and full application—and guides entities through the agency review process, including representation during meetings and agency negotiations.

Major Incentives:

The IRA, which builds on IIJA and CHIPS Act investments, includes the most significant climate investments in U.S. history to support the U.S. economy’s shift to clean energy.

View More

The legislation provides various funding opportunities, as well as comprehensive tax incentives to spur clean energy initiatives and billions in new federal spending for health care priorities. It also includes targeted tax code changes that will impact corporations and investment funds, and sets aside billions in increased tax enforcement funding designed to generate revenue and reduce the federal deficit.

Major components:

Private entities may benefit directly, by receiving grants or tax credits, or indirectly by partnering on public projects. Examples of actionable opportunities include IRA tax credits across many sectors, such as renewable energy production and manufacturing and clean fuels and vehicles.

Direct grants include:

Loan Guarantees include: