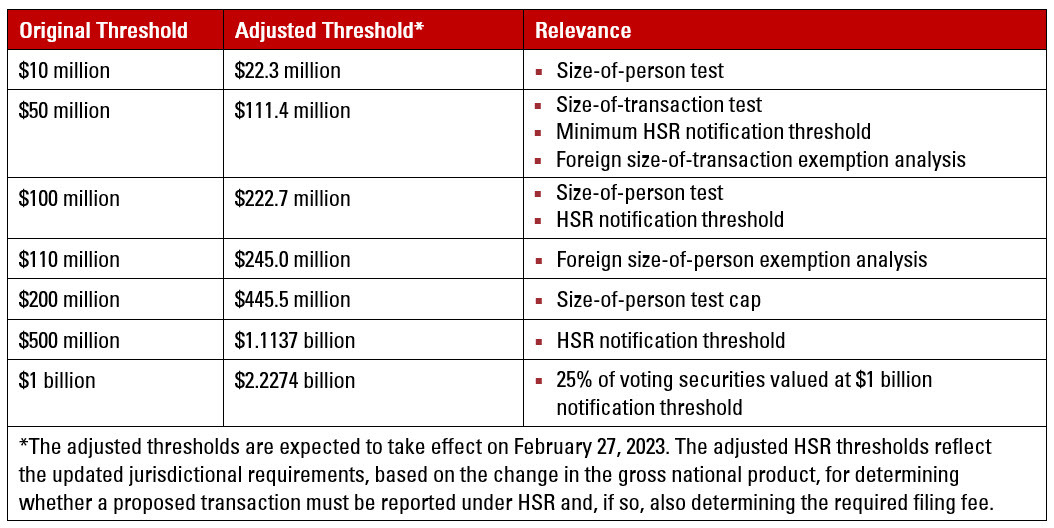

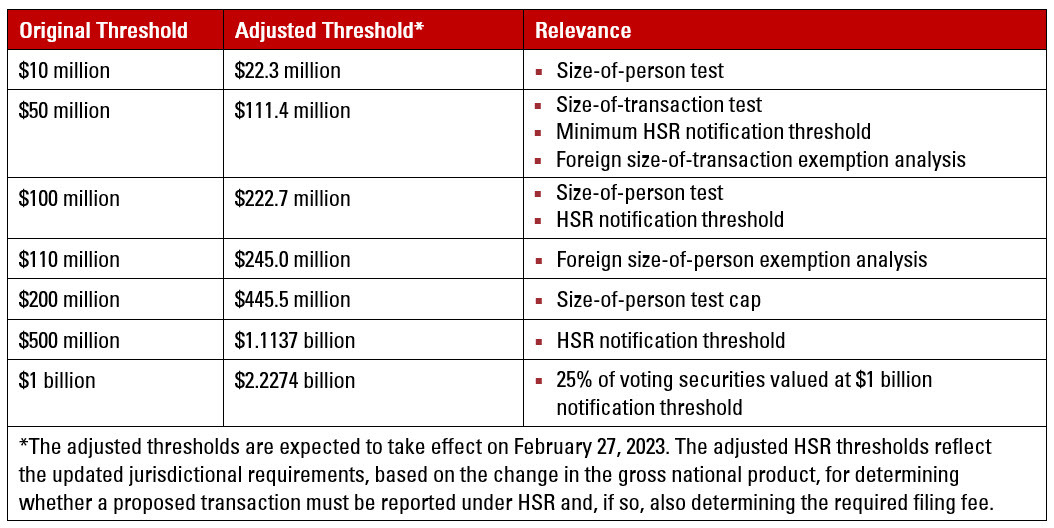

HSR Thresholds Increase. Generally, a transaction will not be reportable under the new thresholds unless it is valued for HSR purposes at more than $111.4 million. If the value of the proposed transaction is greater than $111.4 million but not greater than $445.5 million, the transaction will not be reportable unless the “ultimate parents” of the acquiring and the acquired entities also meet a certain minimum “size-of-person” test—in most instances, where one ultimate parent (including all entities it controls) has net sales or total assets of at least $22.3 million and the other has net sales or total assets of at least $222.7 million. Where the jurisdictional tests are met, the transactions are reportable unless an exemption applies. The table below includes the original and the newly adjusted figures for each relevant HSR threshold (the original figure continues to appear in HSR regulations with the words “as adjusted” to remind the reader that the thresholds are adjusted each year). Parties should be mindful that there are many other factors that impact whether a given transaction is subject to the jurisdictional thresholds in addition to these dollar thresholds.

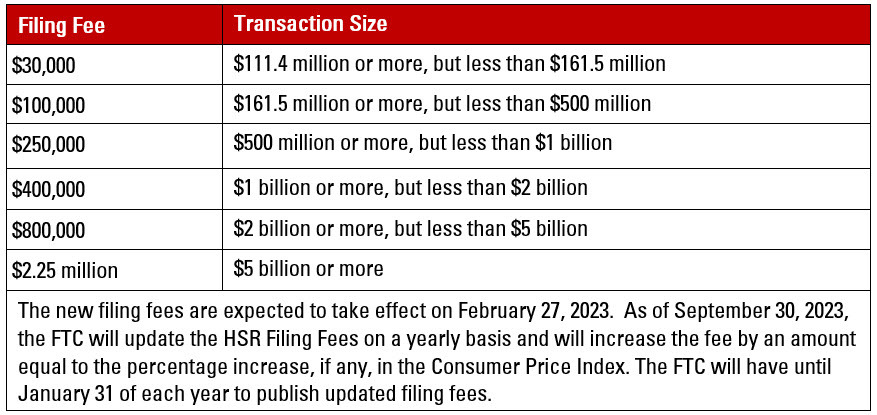

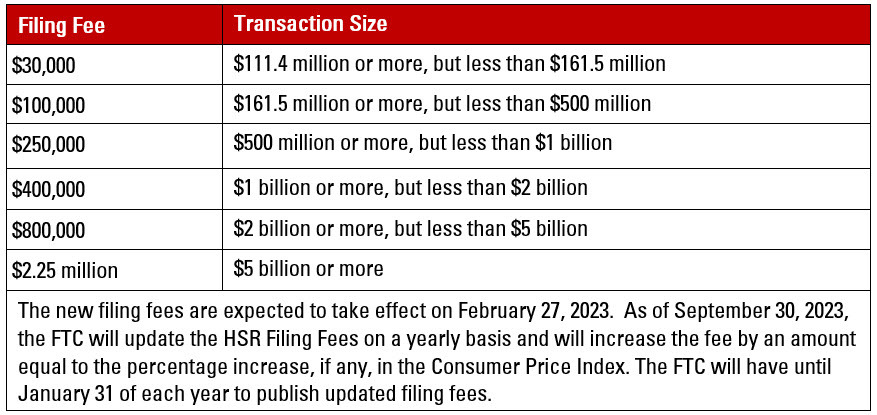

HSR Filing Fees. The filing fees for reportable transactions, which were recently updated pursuant to the Merger Filing Fee Modernization Act, will be as follows:

HSR Violations. Effective January 6, 2023, the maximum civil penalty for HSR Act violations increased from $46,517 to $50,120 per day. The new daily maximum civil penalty applies only to penalties assessed after the effective date, including those penalties whose associated violation predated January 10, 2022. The maximum civil penalty is not affected by the adjustments to the HSR filing thresholds.

Revised Thresholds for Interlocking Directorates. Section 8 of the Clayton Act generally prohibits companies that compete with each other from having interlocking memberships on their corporate boards of directors. The FTC annually revises the jurisdictional threshold that triggers the interlocking directorate prohibition. The annual revisions to the threshold are based on the change in the gross national product and are effective as of January 20, 2023.

- Section 8(a)(1) of the Clayton Act prohibits a person from serving as a director or board-elected or board-appointed officer of two or more corporations if the combined capital, surplus, and undivided profits of each of the corporations exceeds $45,257,000.

- Section 8(a)(2)(A) of the Clayton Act exempts interlocks for which the competitive sales of either corporation are less than $4,525,700.

- Note that the statutory exemptions contained in Sections 8(a)(2)(B) and (C), which exempt interlocks when (i) the competitive sales of either corporation are less than 2% of that corporation’s total sales or (ii) the competitive sales of each corporation are less than 4% of that corporation’s total sales, remain unchanged and are not revised on a yearly basis.