Alert 01.30.24

FTC Announces HSR Threshold and Filing Fee Increases for 2024 Transactions

The size-of-transaction threshold under the Hart-Scott-Rodino Act will increase to $119.5 million, and the largest filing fee will increase to $2.335 million.

Alert

Alert

01.15.25

As a result of the increase in the U.S. Gross National Product (GNP) for 2024, the Federal Trade Commission (FTC) has announced an increase in the jurisdictional filing thresholds for the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR). The minimum size of transaction threshold will increase by $6.9 million, a 5.8% increase, to $126.4 million. The thresholds determine whether parties involved in proposed mergers, consolidations, or other acquisitions of voting securities, assets, or unincorporated interests must notify the FTC and the Antitrust Division of the Department of Justice (DOJ) of a proposed transaction and comply with a mandatory waiting period before the transaction may be consummated. The revised thresholds will take effect on February 21, 2025. Until then, the current $119.5 million threshold is still in effect.

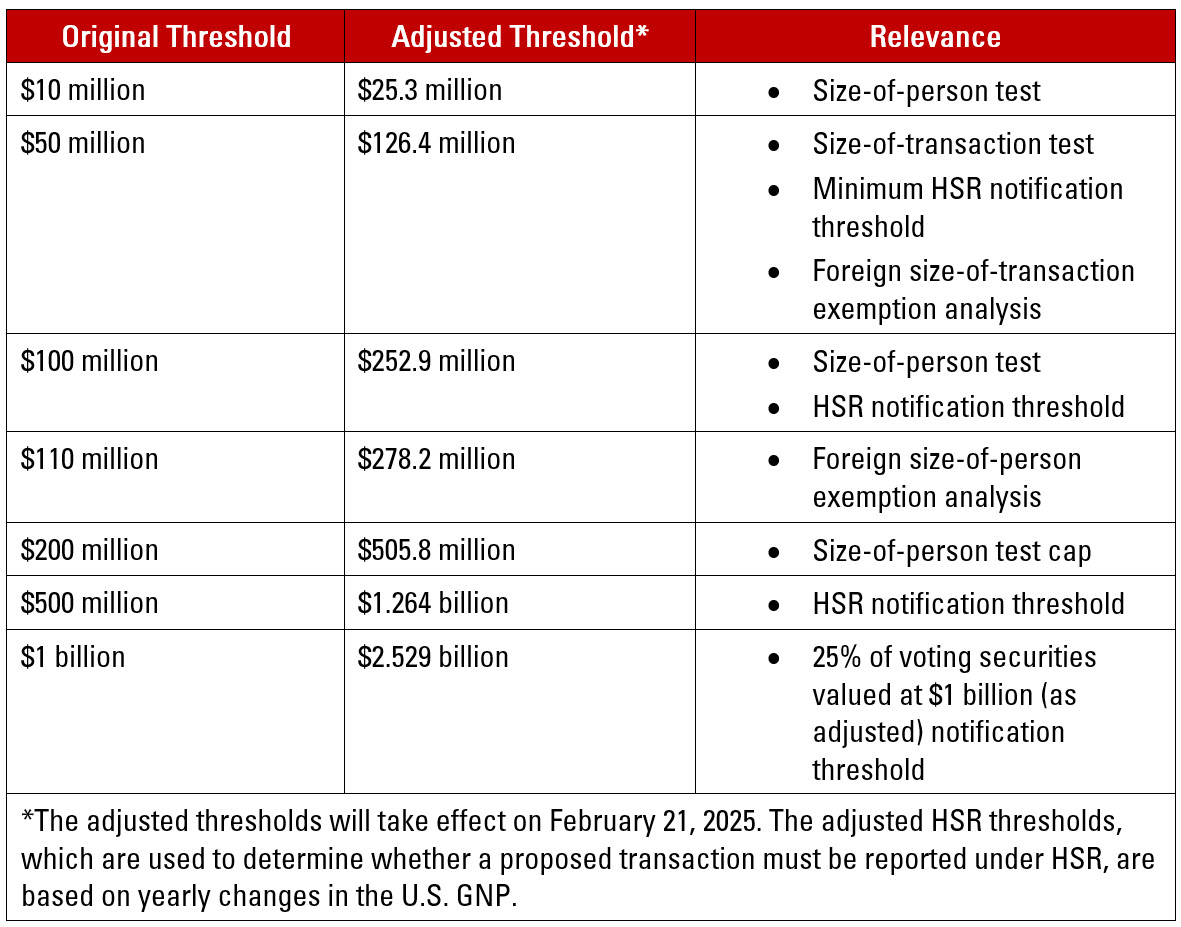

HSR Thresholds Increase. Generally, a transaction will not be reportable under the new thresholds unless it is valued for HSR purposes at more than $126.4 million. If the value of the proposed transaction is greater than $126.4 million but not greater than $505.8 million, the transaction will not be reportable unless the “ultimate parents” of the acquiring and the acquired entities also meet a certain minimum “size-of-person” test—in most instances, where one ultimate parent (including all entities it controls) has net sales or total assets of at least $25.3 million and the other has net sales or total assets of at least $252.9 million. Where the jurisdictional tests are met, the transactions are reportable unless an exemption applies. The table below includes the original and the newly adjusted figures for each relevant HSR threshold. (The original figure continues to appear in HSR regulations with the words “as adjusted” to remind the reader that the thresholds are adjusted each year.) Parties should be mindful that there are many other factors that impact whether a given transaction is subject to the jurisdictional thresholds in addition to these dollar thresholds.

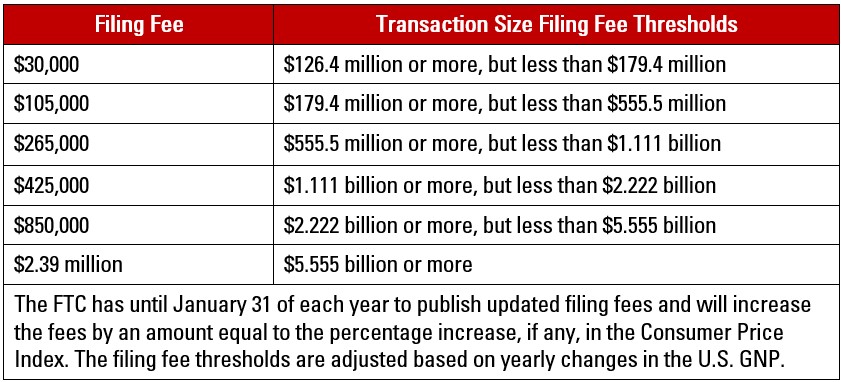

HSR Filing Fees. The filing fees for reportable transactions will be as follows:

HSR Violations. Effective January 17, 2025, the maximum civil penalty for HSR Act violations will increase from $51,744 to $53,088 per day. The new daily maximum civil penalty will apply only to penalties assessed after the effective date, including those penalties whose associated violation predated January 17, 2025. The maximum civil penalty is not affected by the adjustments to the HSR filing thresholds.

Revised Thresholds for Interlocking Directorates. Section 8 of the Clayton Act generally prohibits companies that compete with each other from having interlocking memberships on their corporate boards of directors. The FTC annually revises the jurisdictional threshold that triggers the interlocking directorate prohibition. The annual revisions to the threshold are based on the change in the gross national product and are effective as of January 22, 2025.

.

As these changes take effect in early 2025, companies should be aware of the updated thresholds as they consider proposed mergers, acquisitions, and similar transactions or changes in the composition of their corporate boards or senior officers.